WIND MITIGATION INSPECTION COST

As a homeowner, you will take all the necessary steps to ensure you protect your investment. This, for most people, means making timely repairs and paying homeowners’ insurance to cover unforeseen circumstances. When getting insurance, most insurers will require a wind mitigation report to know your home’s risk level. Insurers will often ask for the report in places prone to hurricanes and strong winds, even for relatively new structures. When people hear of a wind mitigation report, their first question will be how much it will cost. The article below will answer how much a wind mitigation inspection should cost and other questions you might have about this crucial report.

WHAT IS A WIND MITIGATION REPORT?

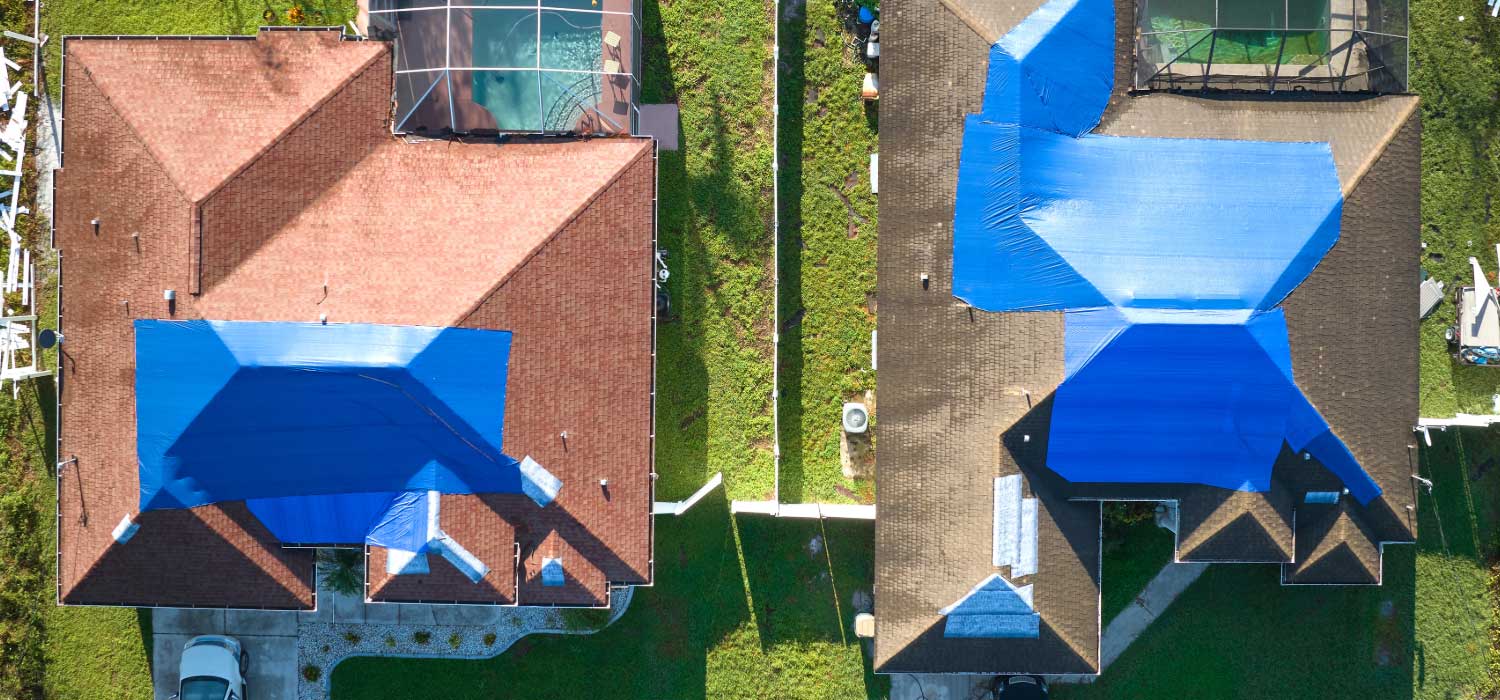

A wind mitigation report determines how well your building is prepared for a major storm or hurricane. An inspector will evaluate your windows, doors, roof attachments, roof coverings, and more for their resistance to high winds. Most homeowners confuse the wind mitigation report for a 4-point inspection. The latter is often required for homes that are over thirty years old. The 4-point inspection checks for issues with your roof, HVAC system, electrical installation, and plumbing system.

WHAT ARE THE BENEFITS OF A WIND MITIGATION INSPECTION?

Most homeowners will only get the wind mitigation report to get some discount on their homeowners’ insurance premium. Besides insurance discounts, a wind mitigation inspection will help you know how secure your home is and what upgrades or repairs you need to make to prevent damage from high winds. You can also get an inspection when selling your home because the report will boost your selling points.

HOW MUCH WILL A WIND MITIGATION INSPECTION COST?

This fee will also include an update on your report if need be within a specified period. Thankfully, in most cases, the costs of your inspection will be recouped in the discounts on your insurance premiums. The price of a wind mitigation inspection is lower if you get it at the same time as your buyer’s home inspection. This is because you will have to cut down on the travel costs of the inspector.

WHAT IS THE WIND MITIGATION CREDIT?

The wind mitigation credit is based on the findings of your inspection. These credits are meant for insurance discounts on your homeowners’ insurance. The credits are based on how many aspects of the inspection your home will pass or fail. In general, if your home can hold up well to strong winds, you get more credits.

You will benefit from a higher insurance premium discount if you have higher credits. The discount ranges from 20-70%. Insurers will exclude wind damage from their standard homeowner's insurance policies in some hurricane and tornado-prone areas. In other cases, they need a separate wind deductible on your policy. Check these elements to ensure you have wind coverage.

WHAT STATES HAVE WIND MITIGATION CREDITS?

A few states have wind mitigation laws under their insurance regulation offices. The laws mandate insurers to give homeowners who have a wind mitigation report credits or discounts. The states with wind mitigation credits include Georgia, Mississippi, Alabama, Oklahoma, North Carolina, Rhode Island, Florida, and Louisiana.

One Last Thought to Consider

A wind mitigation inspection will take 30-60 minutes to complete, so you do not have to cancel your plans to host the inspector for the day. Most inspection firms will send you the report within 24 hours. The wind mitigation report is valid for five years. With your questions on the cost and other aspects of the inspection now answered, you can schedule one for your home.